Imagine you’re Winnie the Pooh; one fine day, you visit your friend Rabbit’s house and notice some honey jars inside Rabbit’s hole. Unable to resist, you squeeze through the entrance, devour the honey, and soon enough, you’ve eaten so much that you can’t get back out. You’re stuck in the entrance, unable to move forward or backward. What seemed like a delightful treat has become a sticky trap, leaving you helpless.

This charming scene from a children’s story mirrors a far less charming reality in cryptocurrency: the honeypot scam. In the crypto universe, a honeypot is a type of scam involving the early listing of a token on decentralized exchanges (DEXs). These tokens look incredibly appealing and promise great returns, but once you buy them, you quickly find out that you can’t sell them. Just like Pooh stuck in Rabbit’s hole, you’re trapped, unable to retrieve your investment.

Let’s dive deeper into the world of crypto honeypots, understand how they work, and learn how to avoid them.

What Is a Honeypot in Crypto?

In the world of cryptocurrencies, a honeypot is a scam where a new token that appears valuable and promising is listed on decentralized exchanges, enticing investors to buy in. However, the twist is that while you can buy the token, you cannot sell it. This makes it a “honeypot” — it looks sweet and lucrative from the outside, but once you’re in, you’re trapped.

How Honeypots Work

1. Creation of the Token: Scammers create a new token and give it an appealing name, often mimicking legitimate projects or creating hype around it.

2. Listing on DEXs: The token is listed on decentralized exchanges like Uniswap or PancakeSwap. These exchanges are popular because they allow anyone to list tokens without rigorous checks.

3. Marketing and Hype: Scammers promote the tokens using various methods, such as social media, forums, influencer endorsements, and fake volume using bots. They create a sense of urgency and FOMO (fear of missing out) to attract buyers quickly.

4. The Trap: Once investors buy the token, they find out that they can’t sell it. This could be due to manipulative smart contract code that restricts selling, exorbitant sell fees, hidden sell requirements, or whitelisted addresses that permit only certain wallets to sell.

5. Profit for Scammers: As the price of the token rises due to increasing demand, scammers can dump their holdings at a profit, leaving investors with worthless tokens.

Real-Life Examples of Honeypots

Example 1: Fake Token with High Sell Fees

A token might be programmed with a smart contract that imposes extremely high sell fees — sometimes as high as 99%. When you attempt to sell the token, the transaction fee makes it virtually impossible to get any value out of it.

Example 2: Blacklisted and Whitelisted Addresses

Some honeypots use a technique where only certain “whitelisted” addresses are allowed to sell the token. Or “blacklisted” addresses are not allowed to sell the token. This means that while anyone can buy the token, only a select few (usually controlled by the scammers) can sell it. This keeps the price artificially high, creating FOMO, and traps regular investors who cannot cash out.

Example 3: Hidden Sell Requirements

In more sophisticated honeypots, the smart contract may include hidden sell requirements that are not apparent at the time of purchase. These requirements can range from holding the token for a certain period to possessing a minimum number of tokens or requiring additional approval from the contract itself before selling is permitted. These hidden conditions can prevent unsuspecting investors from selling their tokens when they want to.

Example 4: Scam Projects Mimicking Legitimate Tokens

Scammers might create tokens that closely resemble legitimate, popular projects. They use similar names and symbols to trick investors into thinking they are buying a reputable token. Once investors realize the scam, it’s too late — they can’t sell the token.

How to Avoid Honeypots: Tips and Best Practices

1. Do Your Own Research (DYOR)

Before investing in any new token, conduct thorough research. Check the project’s website, whitepaper, and team members. Look for community discussions on platforms like Reddit and BitcoinTalk to gauge the token’s legitimacy.

2. Verify Smart Contract Code

If you’re tech-savvy, review the token’s smart contract code. Look for any red flags, such as functions that restrict selling, impose high fees, include hidden sell requirements, or use whitelisted addresses.

3. Check Liquidity

Low liquidity can be a warning sign. If a token has very little liquidity, it might be easier for scammers to manipulate prices and trap investors. Low liquidity usually means very high volatility. Just a few buys can make the token seem like it has gone up 50x in value, creating FOMO.

4. Beware of Hype

Be cautious of tokens that are heavily hyped on social media and by influencers. Scammers often create artificial hype to lure in unsuspecting investors quickly. Botted accounts can be spotted by looking into the type of followers and the quality of replies. Look for organic growth and genuine community engagement instead.

5. Renounced Contract and/or Doxxed Team

Check for a renounced contract, which means the developers have given up control over the smart contract. This is a good sign because it indicates that no one can alter the contract’s code later to introduce malicious features. You can check if a contract is renounced by looking at the contract owner’s address on Basescan. The contract is renounced if the owner’s address is set to a null address (0x000…).

Additionally, only trust doxxed teams where the developers have revealed their identities and backgrounds. This transparency reduces the likelihood of a scam, as it makes the team accountable. Look for projects where team members are active on social media, participate in public discussions, and have verifiable credentials.

7. Test with Small Amounts

If you’re unsure about a new token, test the waters by investing a small amount first. This way, if it turns out to be a honeypot, your losses will be minimized. But be aware that if the contract is not renounced, the developer may later create sell restrictions and change it to a honeypot.

8. Stay Updated

Stay informed about the latest scams and tactics used by cybercriminals in the crypto space. Regularly follow news and updates from trusted sources to stay ahead of potential threats.

Conclusion: Navigate the Crypto World Safely

Honeypots in the crypto world are devious traps designed to exploit the excitement and naivety of investors. They look appealing and promise high returns, but once you’re in, you find yourself trapped without a way to sell your tokens. You can protect yourself from these digital traps by conducting thorough research, verifying smart contracts, and staying vigilant.

Remember, staying cautious and informed in the fast-paced world of cryptocurrency is essential. Don’t let the promise of quick gains cloud your judgment. Stay smart, stay safe, and stay educated!

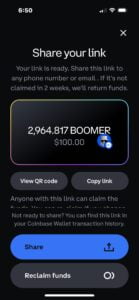

Disclaimer: The content provided here is not financial advice. Its purpose is to educate and contribute to the vision of BoomerOnBase in onboarding the next 10,000,000 boomers to @base. Please conduct your own research and consult with a financial advisor before making any investment decisions.

Engaging with the Boomer Community

To take the next step in your crypto journey, immerse yourself in the vibrant Boomer community through various channels:

- Telegram: Join the Boomer Telegram group to connect with like-minded individuals, share insights, and stay updated on the latest developments in the crypto sphere.

- YouTube: Dive into Boomer’s YouTube channel for educational content, tutorials, and interviews with industry experts, empowering you with knowledge and inspiration to navigate the crypto landscape.

- Social Media: Follow Boomer on Twitter, Instagram, and Facebook to engage with the community and participate in discussions.

By actively engaging with the Boomer community, you can unlock a wealth of resources, support, and camaraderie on your journey towards crypto enlightenment.

Follow @BoomerOnBase on X for more insights.

Or visit us at https://baseboomer.com/ to learn more